What is a Tax Code? Understanding your Tax Code

Anyone who is employed, or has income through PAYE, is given a tax code by the tax office (HMRC).

Your tax code is important because it tells your employer how much income tax should be taken from your salary.

As an employed person you should understand and check your tax code because HMRC places the responsibility on you to check your own code and to contact them if it’s incorrect.

This means learning about how the tax code system works is important so you can manage your tax code in the best way.

If your tax code is later to be found wrong, you could miss out on a tax rebate or be landed with an unforeseen tax bill.

A tax code covers all income received through the pay as you earn system which includes income from a private or state pension but not from self employment.

Our tax code guide let’s you know more about why you have been given your current tax code, how to verify the accuracy of your code and how to contact HMRC if you need tax code support.

Checking your tax code

Checking your tax code is correct is important because the tax office expect you to let them know if you think it is wrong.

A tax code is usually made up of three or four numbers and one letter, for example 1234L, and can be found on your payslip.

The numbers reflect the tax free personal allowance amount that you are entitled to in that tax year. You do not start paying income tax until you are earning over your personal allowance figure.

How is my tax code worked out?

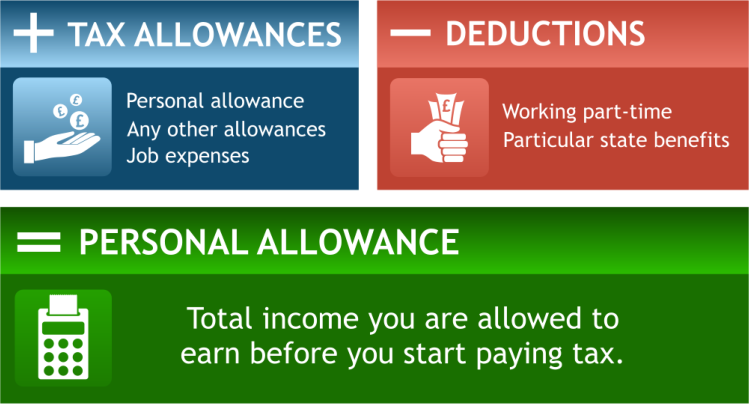

The tax office works out your tax code by:

- Firstly, your tax allowances are worked out. Normally this will be your personal allowance added to any other allowances, and job expenses if you have any.

- Secondly any income that you have not already paid tax on is calculated, like working part-time or particular state benefits. These are called your ‘deductions’.

- Your deductions are then subtracted from your total tax allowances. The figure that is calculated is the total income you are allowed to earn before you start paying tax. The calculation for the maximum you can earn tax free is: ‘total deductions’ minus ‘total allowances’ equals personal allowance.

- This personal allowance figure is multiplied by 10 and becomes the number section in your tax code.

As an example, the tax code 1100L would mean:

Your Personal Allowance is £11,000

£11,000 will be subtracted from your total taxable income. The figure that is left you will need to pay tax on.

How can I verify my tax code with HMRC?

HMRC provides an online platform that is user friendly and designed to help individuals understand and verify their tax code.

By using the “check your tax code” tool on the .GOV website you can gain a clear understanding of your tax code and identify any necessary adjustments.

The online tool is easily accessible and does not require users to log into any account so there is no need to remember any login credentials.

You can use the check your tax code tool as many times as needed at your own convenience which ensures that you have access to HMRC guidance whenever changes occur to your code.

What does the letter in my tax code mean?

The letter part of your tax code is used to show a change to a code which is particular to your circumstances.

Common tax code letters and definitions:

L – you are younger than 65 and get the basic Personal Allowance.

K – Most commonly used if you have a company benefit like a car and means you don’t have any tax free personal allowance.

BR – Stands for basic rate, currently set at 20%. If you have a second job, this is the most likely code you will receive.

Y – You are older than 75 and get the maximum Personal Allowance.

DO – You are a Higher Rate Taxpayer, currently set at 40%.

NT – You have income that is Not Taxable.

W1, M1 and X – If your tax code ends in W1, M1 or X this means you have an emergency tax code meaning you will pay tax on your income above the tax free personal allowance.

Does my personal allowance affect my tax code?

Employed individuals receive a personal allowance which entitles them to tax free earnings up to the personal tax allowance threshold.

HMRC uses the personal allowance to formulate your tax code which means ensuring the accuracy of your personal allowance plays an essential role in having a correct code.

Not everyone’s personal allowance is the same with a number of factors potentially increasing or reducing the basic personal allowance in that tax year.

For example if you have a company car benefit given to you by your employer this will reduce your tax free personal allowance because you have to pay more tax due to the company car benefit in kind.

When do I get a new tax code?

You will usually be issued a new tax code from the tax office as the new tax year begins or when you have a change in circumstances. Both you and your employer will be sent your new tax code.

HMRC should automatically show your most up to date tax code in the tax code section of your personal tax account.

Using the HMRC app or your online personal tax account is often the easiest way to check what your current tax code is and if any changes have been made recently.

You might receive your new tax code on a form called a P2 notice of coding either online or by post.

Not everyone will receive a P2 for example if you just have a standard tax code the tax office would not normally send you a P2.

Why would my tax code be wrong?

The use of an incorrect tax code can happen for various reasons.

The good news is it can be changed quickly which will allow for any overpayment of tax to be refunded or underpayment of tax to be collected.

Some of the most common reasons include:

- You have changed jobs and were given an emergency tax code.

- You no longer have a company benefit, like a health scheme.

- You have work expenses that you are not claiming tax relief for. Income tax code allowances can be put into your tax code meaning you will pay less tax because you have work related expenses. You can also get a tax rebate back dated for the last four tax years.

- Administrative errors by either your employer or HMRC.

An incorrect tax code has one of two possible outcomes: you are owed money back from HMRC because you have paid too much tax or, you owe HMRC because you haven’t paid enough tax.

Highlighting the tax code being wrong as soon as possible is key to ensuring your tax code is adjusted in the quickest time possible.

Changing your tax code with HMRC

If you require assistance or have any inquiries regarding your tax code or personal allowance you should reach out to HMRC also known as the tax office.

The tax office can sometimes need you to tell them about certain circumstances so they can arrange for your tax code to be altered.

You or your employer cannot change your tax code with only HMRC being able to issue a new code.

When a new tax code is prepared it will be sent electronically to your employer for them to use in your next pay.

To address any concerns or questions you may have about your tax code HMRC offers a dedicated online platform.

Alternatively if you would prefer to speak with an HMRC advisor you can contact them on their tax helpline phone number 0300 200 3300.